TAX POLICY LEADERS PUSH FOR NEW MARKETS TAX CREDIT PERMANENCE

Tax policy trends and community economic development were the focus at the New Markets Tax Credit (NMTC) Coalition annual NMTC Conference,

Momentum Continuing to Build Behind NMTC Extension Act of 2023

Senator Deb Fischer (R-NE) and Representative Mike Ezell (R-MS) join as cosponsors

NMTC Projects in Minority Leader Jeffries District

Highlighting projects and impact in NY08

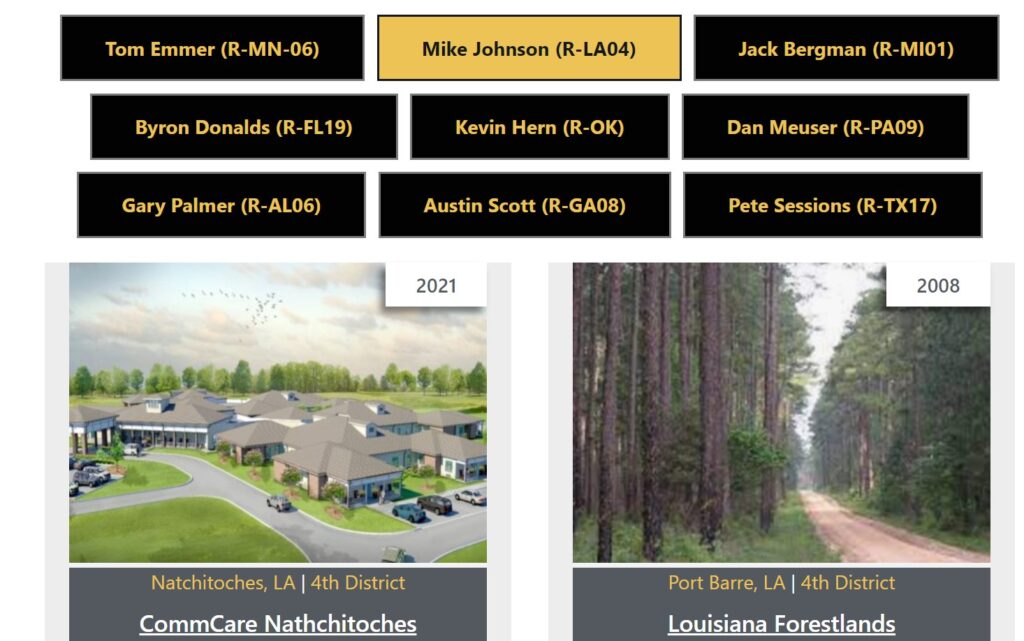

NMTC Projects in Speaker Candidate Districts

NMTC highlights in speaker candidates districts

2023 NMTC Allocation Round Officially Opens Tomorrow

Application due Dec. 19, 2023

NMTC Coalition, 700 Organizations Urge White House, Congressional Leadership to Make NMTC Program Permanent

Today, the New Markets Tax Credit (NMTC) Coalition, a national membership organization of Community Development Entities (CDEs) and investors organized to advocate on behalf of the NMTC, released a letter signed by nearly 700 community development stakeholders