Chairman Richard Neal (D-MA) confirms as Annual Conference Keynote

House Ways and Means Committee Chairman Richard Neal (D-MA) has confirmed his participation in the 2021 NMTC Coalition Policy Conference on December 15th.

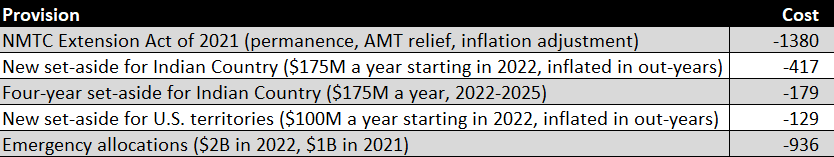

Round-up of recent NMTC scores

The Joint Committee on Taxation has scored several NMTC provisions over the past few weeks. Below is a roundup: Provision 10…

NMTC Coalition Urges White House and Congressional Leadership to Make the NMTC Permanent within the Final Federal Appropriations Package

Today, the New Markets Tax Credit (NMTC) Coalition, a national membership organization…

The Case for NMTC Permanence

Congress has an opportunity to make one of the federal government’s most successful community development programs permanent at the low, ten-year cost of $1.38 billion

Sign-on in support of a permanent, expanded NMTC

Tell Congress to make the NMTC permanent and expand its reach

Testimonials from Constituents

The NMTC Coalition has collected testimonials from over 400 community leaders, businesses, nonprofits, CDEs, investors, and ot…