No June Conference in 2024

The NMTC Coalition will not be holding a conference this June. We’re having a fly-in for the NMTC Coalition Board. If you’re a Coalition member

The NMTC Coalition will not be holding a conference this June. We’re having a fly-in for the NMTC Coalition Board. If you’re a Coalition member

Ways and Means Chairman Smith (R-MO) and Tax Subcommittee Chair Mike Kelly (R-PA) recently released a list of newly formed working groups to study key provisions and make recommendation

Tax policy trends and community economic development were the focus at the New Markets Tax Credit (NMTC) Coalition annual NMTC Conference,

Senator Deb Fischer (R-NE) and Representative Mike Ezell (R-MS) join as cosponsors

Highlighting projects and impact in NY08

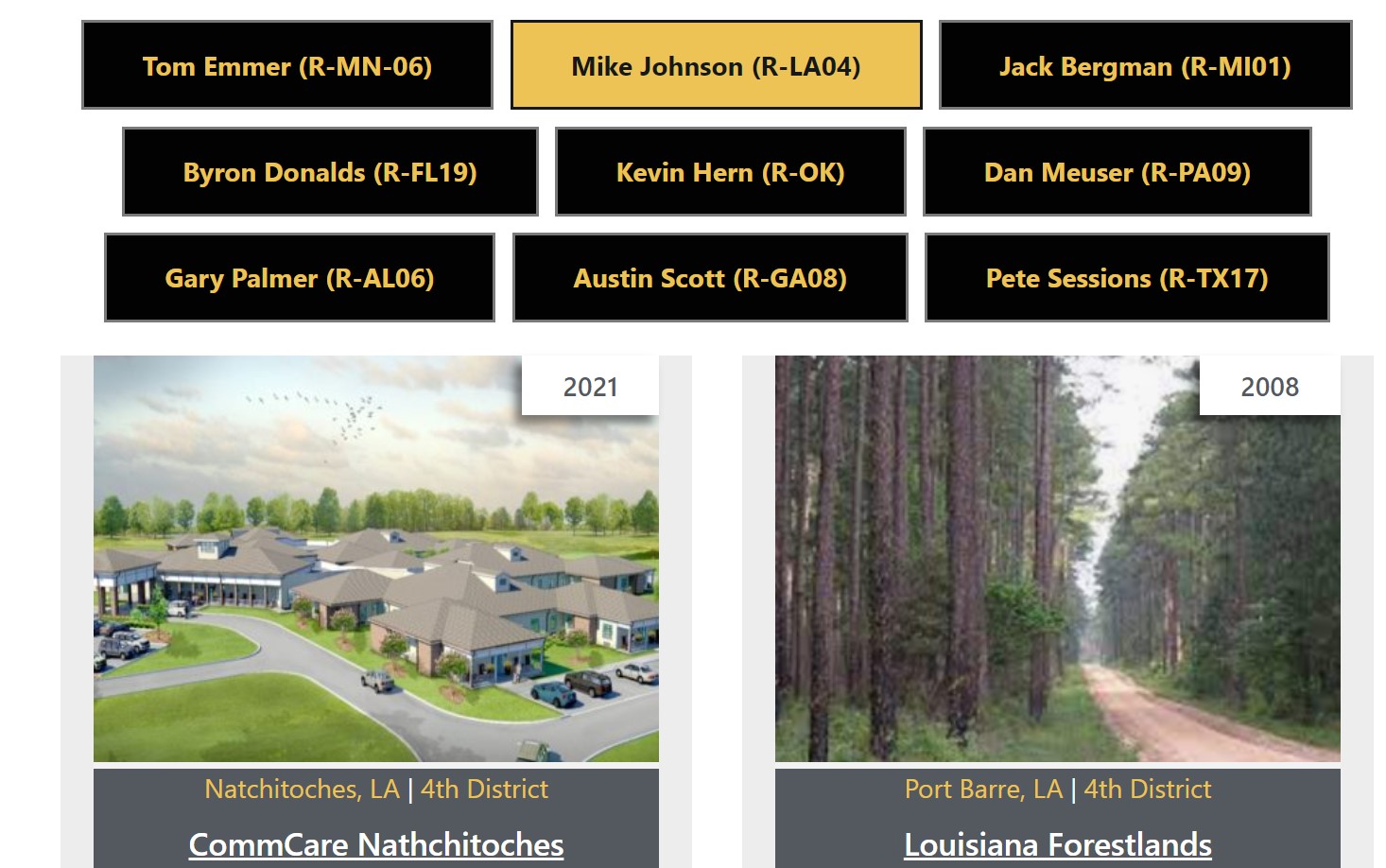

NMTC highlights in speaker candidates districts

Today, the New Markets Tax Credit (NMTC) Coalition, a national membership organization of Community Development Entities (CDEs) and investors organized to advocate on behalf of the NMTC, released a letter signed by nearly 700 community development stakeholders